Pennsylvania Tax On Gambling Winnings

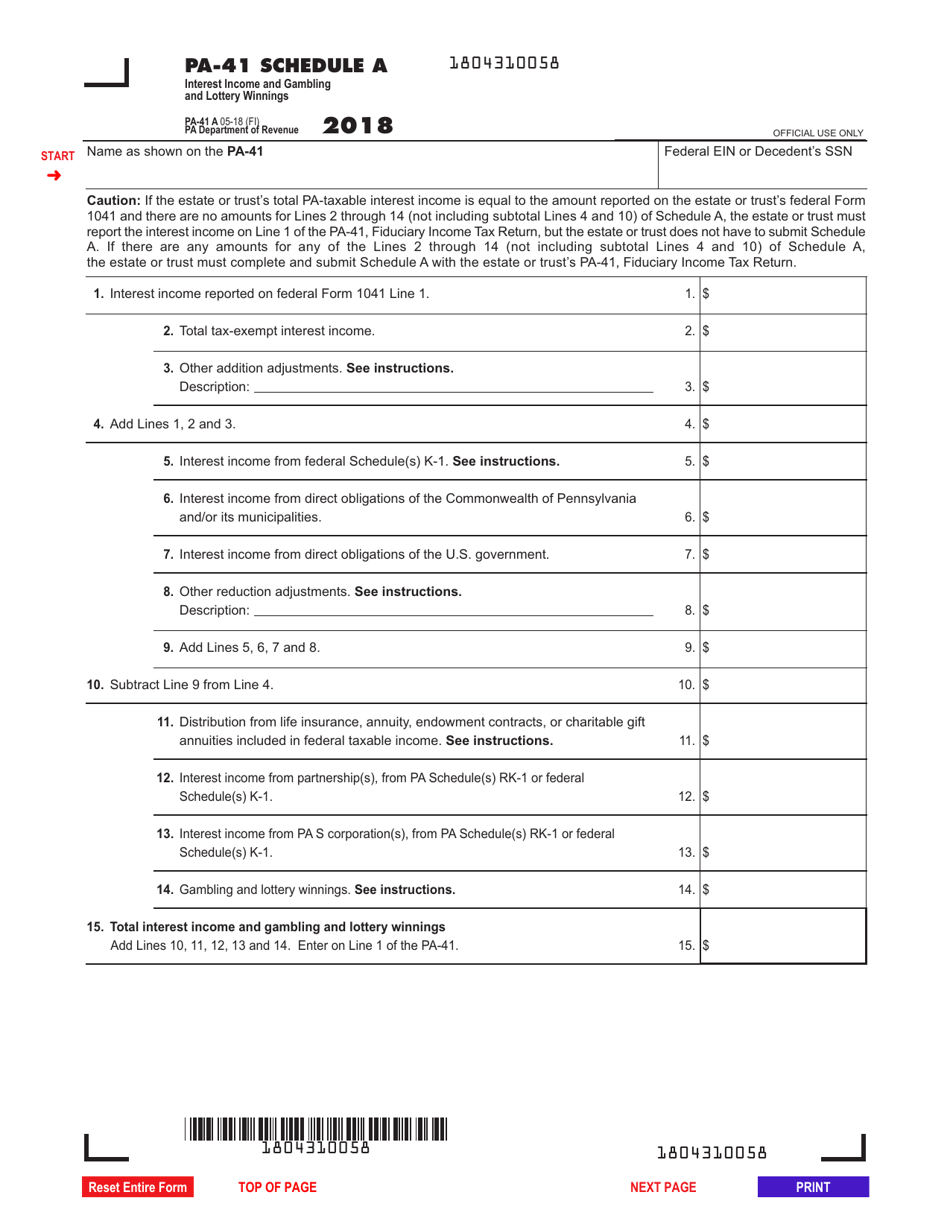

- Sometimes the payer (the one paying your winnings; e.g., the casino) must issue you a form with your winnings and any withholding for your taxes if your winnings reach certain levels, which vary by type of gambling. (The last instruction page of the Form W-2G lists threshold amounts of winnings requiring that the form be issued to you.).

- Nonresidents must include all gambling and lottery winnings from Pennsylvania sources except noncash winnings from the Pennsylvania Lottery. Refer to the PA Personal Income Tax Guide – Gambling and Lottery Winnings section for additional information. RECORDING DOLLAR AMOUNTS Show money amounts in whole-dollars only.

- Thus, for nonresidents, all gambling winnings over $5,000 and which are subject to federal withholding are also subject to New York State tax, starting for tax year 2019. See the Instructions for Form IT-203 Nonresident and Part-Year Resident Income Tax Return, page 3. The tax bulletin you refer to needs to be updated.

- Does Pennsylvania Tax Gambling Winnings

- Pa Local Tax Gambling Winnings

- Pennsylvania Tax On Gambling Winnings

- Pa Income Tax Gambling Winnings

- Pennsylvania State Tax On Gambling Winnings

Pennsylvania does not tax nonresident individuals, estates or trusts on gambling and lottery winnings by reason of a wager placed outside this Commonwealth, the conduct of a game of chance or other gambling activity is located outside this Commonwealth or the redemption of a lottery prize from a lottery conducted outside this Commonwealth.

➝ ResearchState of Play

Explore the national and state-by-state impact of the casino gaming industry, as well as key regulatory and statutory requirements in each state.

Number of Casinos 12

Economic Impact $6.34 Billion

Jobs Supported 33,171

Tax Impact $2.48 Billion

Gross Gaming Revenue $3.38 Billion (2019)

Size of circle indicates number of casinos in the area.

All location data is as of Dec. 31, 2019.

Pennsylvania Gaming Control Board

303 Walnut Street, 2nd Floor

Strawberry Square

Harrisburg, PA 17106

717-703- 8300

Website

Section 1201 of title 4 of the Pennsylvania Consolidated Statutes establishes the Pennsylvania Gaming and Control Board (PGCB). The board is tasked with supervising casinos as well as slot machines at racetracks, online casino gaming and sports betting.

AVAILABLE GAMING LICENSES

Category One – Racetrack Facilities License

Category One – Racetrack Facilities, Addition of Table Games License

Category Two – Standalone Casino License

Category Two – Standalone Casino, Addition of Table Games License

Category Three – Resort-style Casino License

Category Three – Resort-style Casino, Addition of Table Games License

Category Four – Ancillary Casino License

Category Four – Ancillary Casino, Addition of Tables Games License

Interactive Gaming Certificate

Interactive Gaming Operator License

Manufacturers License

GAMING TAX RATE

Pennsylvania imposes a 34 percent tax on the gross revenues collected from slot machines. On top of this, the state has placed an additional tax of up to 12 percent for the Pennsylvania Race Horse Improvement Assessment, a 5 percent tax that will go to the Pennsylvania Gaming and Economic Development and Tourism Fund, and, finally, a 4 percent tax or $10m, whichever is greater, that will go to the host community. In total, up to 55 percent of revenues generated from slot machines will go to the government in the form of taxes.

Effective August 2016, operators will pay taxes equal to 16 percent of daily gross table game revenues, up from 14 percent. The additional two percent tax is set to expire in 2019. In addition, operators must pay 34 percent of its daily gross revenues from each table game played on a fully automated electronic table game at its licensed facility.

TAX PROMOTIONAL CREDITS

None

WITHHOLDINGS ON WINNINGS

Gambling winnings are taxable income and are taxed at 3.07 percent.

| TAX ALLOCATION |

| The proceeds of the tax on slot machine revenues from Category 1, 2, and 3 casinos is distributed as follows: |

|

| The effective tax rate for Category 4 casinos is 50 percent and is distributed as follows: |

|

STATUTORY FUNDING REQUIREMENT

The greater of $2 million or .002 multiplied by the total gross terminal revenue of all active and operating licensed gaming entities. Category Four gross terminal revenue is excluded.

SELF-EXCLUSION

Yes

COMPLIMENTARY ALCOHOLIC DRINKS

Yes

ADVERTISING RESTRICTIONS

Must contain help for problem gambling message

ON-PREMISE DISPLAY REQUIREMENT

Preapproved by Office of Compulsive and Problem Gambling

AGE RESTRICTIONS

21+ years of age on floor

TESTING REQUIREMENTS

Conducted through the Bureau of Gaming Laboratory Operations, division within the PGCB.

ANTI-MONEY LAUNDERING REQUIREMENTS

Federal compliance requirements and PA-specific “suspicious transactions” report requirements for transactions over $5,000.

SHIPPING REQUIREMENTS

Notification of intention to ship into, within or out of state to Bureau of Gaming Laboratory Operations and Bureau of Casino Compliance.

Does Pennsylvania Tax Gambling Winnings

RESTRICTIONS ON POLITICAL CONTRIBUTIONS

In September 2018, Pennsylvania’s blanket prohibition on political contributions from those involved in the gaming industry was struck down in federal court. The opinion declared the law overly broad and unconstitutional.

CREDIT OFFERED TO PATRONS

Yes

AUTHORIZED OPERATORS

Commercial casinos, racinos & online operators

MOBILE/ONLINE

Allowed statewide

Pa Local Tax Gambling Winnings

TAX RATE

36 percent

Pennsylvania Tax On Gambling Winnings

INITIAL LICENSING FEE

$10 million

LICENSE RENEWAL FEE

$250,000, payable every 5 years

AMATEUR RESTRICTIONS

None

OFFICIAL DATA MANDATE

None

Pa Income Tax Gambling Winnings

Pennsylvania State Tax On Gambling Winnings

INTEGRITY FEE

None